- Collaborations

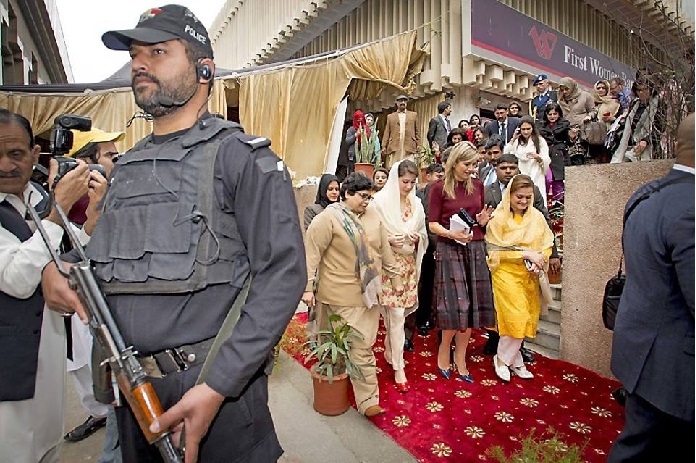

- Photo Gallery

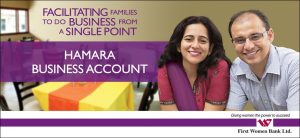

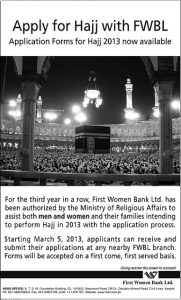

- Advertisement

- Newsletter

- Audio & Video

National

International

- Newsletter in the PDF format [January 2022 to June 2022]

- Newsletter in the PDF format [October 2020 to March 2021]

- Newsletter in the PDF format [January to March 2020]

- Newsletter in the PDF format [July to September 2019]

- Newsletter in the PDF format [January to March 2019]

- Newsletter in the PDF format [April to June 2018]

- Newsletter in the PDF format [October to December 2017]

- Newsletter in the PDF format [April to June 2017]

- Newsletter in the PDF format [October to December 2016]

- Newsletter in the PDF format [April to June 2016]]

- Newsletter in the PDF format [October to December 2015]

- Newsletter in the PDF format [April to June 2015]

- Newsletter in the PDF format [October to December 2014]

- Newsletter in the PDF format [April to June 2014]

- Newsletter in the PDF format [October to December 2013]

- Newsletter in the PDF format [April to June 2013]

- Newsletter in the PDF format [October to December 2012]

- Newsletter in the PDF format [April to June 2012]

- Newsletter in the PDF format [October to December 2011]

- Newsletter in the PDF format [April to June 2011]

- Newsletter in the PDF format [April 2021 to September 2021]

- Newsletter in the PDF format [April to September 2020]

- Newsletter in the PDF format [October to December 2019]

- Newsletter in the PDF format [April to June 2019]

- Newsletter in the PDF format [July to December 2018]

- Newsletter in the PDF format [January to March 2018]

- Newsletter in the PDF format [July to September 2017]

- Newsletter in the PDF format [January to March 2017]

- Newsletter in the PDF format [July to September 2016]

- Newsletter in the PDF format [January to March 2016]

- Newsletter in the PDF format [July to September 2015]

- Newsletter in the PDF format [January to March 2015]

- Newsletter in the PDF format [July to September 2014]

- Newsletter in the PDF format [January to March 2014]

- Newsletter in the PDF format [July to September 2013]

- Newsletter in the PDF format [January to March 2013]

- Newsletter in the PDF format [July to September 2012]

- Newsletter in the PDF format [January to March 2012]

- Newsletter in the PDF format [July to September 2011]

- Newsletter in the PDF format [January to March 2011]

AUDIO

Video

- Success Stories

- Special Reports

-

Press Clipping

-

Media Releases

- Rehabilitation

SME Finance

Najeeba Zulfiqar (Bee Gee) is one of the most well-known designers in the fashion industry. She has been designing dresses for popular film and TV stars for many years now. She started her business back in 1985 and has come a long way since. Having firmly established herself in the local fashion industry, she expanded her horizon and went global, winning critics’ accolades at various international fashion shows and exhibitions across the world. Bee Gee designs all kinds of dresses – from bridal, formal, casual to party wear, costumes for films, dramas, etc. She enjoys a loyal customer base in Pakistan, UK, USA, Canada and India.

Najeeba Zulfiqar (Bee Gee) is one of the most well-known designers in the fashion industry. She has been designing dresses for popular film and TV stars for many years now. She started her business back in 1985 and has come a long way since. Having firmly established herself in the local fashion industry, she expanded her horizon and went global, winning critics’ accolades at various international fashion shows and exhibitions across the world. Bee Gee designs all kinds of dresses – from bridal, formal, casual to party wear, costumes for films, dramas, etc. She enjoys a loyal customer base in Pakistan, UK, USA, Canada and India.

When it comes to banking needs, Najeeba has always relied on FWBL. She says, “First Women Bank Ltd. has always been there to help me meet my growing business requirements”.

Beo Zafar is a poet, writer, TV anchor, comedian and business woman.

Beo Zafar is a poet, writer, TV anchor, comedian and business woman.

Possessing such a multifaceted personality, it’s not surprising to see where Beo stands today. Running a very successful salon business in Karachi for almost 8 years now, Beo decided to venture into arts and literature, when she and her dear friend and painter Tabinda Chinoy launched a poems and paintings book by the name of “The Dreamer Awakens”. Beo says, “This collection of poems is what I managed to salvage (of my random writings) when I decided to publish, and it was only then that I noticed a common strain running through almost all of them: the urge to move from duality to oneness”. Ever since Beo opened her salon in Karachi, she has been banking with FWBL. And once again with the launch of her book, she has found us to be an ever-reliable partner.

Tabinda Chinoy is an artist and sculptor and has held solo and group shows in leading galleries internationally. She is a Director of the Central Institute of Arts and Crafts, Karachi and gives art appreciation lectures at the Aga Khan University, Karachi. Nagi, one of Pakistan’s senior-most artists introduced her to art when he asked her to paint in the vast basement studio of his house alongside some of Pakistan’s all time greats, Ahmed Parvez and Bashir Mirza. She and Beo Zafar recently launched their book “The Dreamer Awakens”. In the words of Tabinda, As for this book, it was an amazing connection. We were stunned to discover when we put our work together, that the poems were as much my journey as they were Beo’s; mine expressed in paint, hers in verse, but speaking the same language.

Tabinda Chinoy is an artist and sculptor and has held solo and group shows in leading galleries internationally. She is a Director of the Central Institute of Arts and Crafts, Karachi and gives art appreciation lectures at the Aga Khan University, Karachi. Nagi, one of Pakistan’s senior-most artists introduced her to art when he asked her to paint in the vast basement studio of his house alongside some of Pakistan’s all time greats, Ahmed Parvez and Bashir Mirza. She and Beo Zafar recently launched their book “The Dreamer Awakens”. In the words of Tabinda, As for this book, it was an amazing connection. We were stunned to discover when we put our work together, that the poems were as much my journey as they were Beo’s; mine expressed in paint, hers in verse, but speaking the same language.

As we proceeded matching poem to painting, we realized with awe that a book was being born.

Ms. Ruth Paul is a foreign qualified beautician who has been in this industry since 1982. On her return from London, where she had gone to do courses in beautician training, she started her own enterprise. At that time, she had a savings account with FWBL. Her association with the bank was further strengthened when she decided to apply for a loan to expand her business.

Ms. Ruth Paul is a foreign qualified beautician who has been in this industry since 1982. On her return from London, where she had gone to do courses in beautician training, she started her own enterprise. At that time, she had a savings account with FWBL. Her association with the bank was further strengthened when she decided to apply for a loan to expand her business.

All the equipment required for her business was imported from Dubai. Ruth believes that her talent and hard work have been augmented by the loan she acquired from FWBL. “It has helped me double my skills and commitment. Being a single woman with no family support, I am grateful to FWBL for helping me stand on my own feet”.

Her loan tenor finishes in June and she intends to seek more financing from FWBL to help her set up a health center. Never say die has been her motto in life that has helped her become such a successful woman entrepreneur.

Dr. Tanveer is a medical doctor by profession and has specialized in radiology and ultrasound. She established her own clinic 17 years back through FWBL’s credit financing facility. Hailing from a conservative background, she has defied societal norms by setting up her own business countering resistance from various quarters.

Dr. Tanveer is a medical doctor by profession and has specialized in radiology and ultrasound. She established her own clinic 17 years back through FWBL’s credit financing facility. Hailing from a conservative background, she has defied societal norms by setting up her own business countering resistance from various quarters.

She has always had a passion to excel in this particular field. To her, ultrasound is the most important part of treatment of ailments as it involves diagnosis of the patient, helping the physician understand where the problem actually lies.

Ultrasound machinery and equipment is quite expensive and technological advancement in this field calls for constant upgradation. FWBL has always been her solution whenever she has been in need of capital to upgrade her setup.

As the field of ultrasound continues to make rapid advancements, Dr. Tanveer realizes that her setup would constantly need to respond to the technological changes. In FWBL, she knows she has a reliable partner who will always be there to help her.

PMYBL Success Stories

Mrs. Jamala Gul Nigar belongs to the village Ismaila District Sawabi, with a keen interest in growing unseasonal vegetables. Taking the first step to pursue her passion, she applied for the Prime Minister’s Youth Business Loan (PMYBL) through First Women Bank Limited (FWBL) to start her own business. After availing the loan, she fully utilized the land to optimize her resources and cultivate the crop, while creating employment opportunities for 9 people.

Mrs. Jamala Gul Nigar sold the first crop of cabbage 5 months ago and received a very good response from the market. Now she is optimistic about her tomato and potato crops which are being cultivated. Mrs. Nigar is very satisfied and happy with the flourishing position of her business.

Ms. Madeeha Nasir applied to the PM’s Youth Business Loan through FWBL to open a boutique. She was amongst the successful candidates of PMYBL’s 2nd balloting and was provided with the loan in July 2014.

Within a short span of 5 months after starting her business, this young and energetic lady managed to properly set up a boutique at her residence in Satellite Town, Rawalpindi. She has also engaged 1 helper and 3 tailors.

Ms. Nasir started earning profits from her business by making focused marketing efforts in the neighbouring areas where a large number of girls’ colleges and hostels are located.

Ms. Wajeeha Ishaq is another successful applicant of the PM’s Youth Business Loans’ 1st balloting result.

The loan amount was disbursed in March 2014, and from there on she never looked back. Within 10 months, she started a day care centre along with her patron, Mrs. Shahnaz, who is managing the Montessori school run on the ground floor. The day care centre is established on the first floor so that the babies don’t get disturbed by the toddlers studying at the school.

Currently, Aagosh Montessori & Day Care Centre has 6 babies enrolled in the day care centre, and is expecting new admissions as more parents are enquiring about the details.

Ms. Wajeeha is happy with her business and plans to expand it further.

Ms. Nadia Zeb is also one of the PM’s Youth Business Loan Program beneficiaries. Prior to availing the loan, Ms. Nadia was managing her husband’s utility store franchise in Rawalpindi with limited products to offer.

In order to meet the growing customer demand of a variety of products, she applied for PM’s Youth Business Loan. The loan was disbursed to Ms. Nadia Zeb in April 2014.

She utilized it for purchasing a stock of different products in bulk and opened a superstore through which Ms. Nadia has created an employment opportunity for one more person on a monthly salary basis. Ms. Nadia mentioned that her business has flourished exponentially after availing the PMYBL.

Ms. Roheena Ayub, the sole proprietor of Mehmoona Beauty Parlor, is a resident of Rawalpindi where she runs a beauty parlour, training centre and a ladies accessories’ shop on a small scale. She wanted financial assistance to revamp the parlor and enhance the services offered to her clients; she approached FWBL for the PM’s Youth Business Loan facility. After the disbursement of the loan, she purchased a wide range and stock of products, an LED TV and replaced the parlor’s cemented floor with tiles. With these changes, Ms. Roheena has witnessed progress in her business. Ms. Roheena outlines the positive impact of the PMYBL facility on her business. After receiving the loan, she has also been able to employ 2 people on a monthly salary basis.

A graduate from National College of Arts (NCA) (2013 batch), Ms. Xhura Hafeez availed a loan from FWBL and set up her door manufacturing business under the name of ‘DarSaaz’, with a focus on creative restoration. Ms. Hafeez’s concept is not just a business model; it truly represents bringing back the pride in products made in Pakistan.

The products produced by DarSaaz are handmade and crafted by local artisans. DarSaaz is currently operating from its office in Bani Gala, Islamabad. Ms. Hafeez is happy with the growth of her business, and is also making the effort to participate in various exhibitions.

Ms. Areeba Khan is another beneficiary of the PM’s Youth Business Loans. Inspired by her mother and aunt, both of whom have been related to the beauty salon business for the past 15 years, Ms. Areeba too wanted to establish her own beauty salon, for which she acquired formal training and worked three years at her mother’s salon.

After availing the loan in November 2016, Ms. Areeba established her beauty salon ‘Beauty Rays’ and provided employment opportunities to 4 people. She is quite satisfied by the pace of her business growth and plans to expand in the future.

Mrs. Farhana Abbas, an experienced beauty professional and owner of ‘Aleena Beauty Parlor’ in Gujranwala, availed a loan from FWBL for the expansion of her beauty parlor. With FWBL’s help, her parlor is now equipped with all the related tools and equipment.

She has created employment opportunities for 4 more people. She’s delighted to share that her business has flourished in leaps and bounds after availing the PMYBL.

With a Master’s of Science in Applied Psychology from University of Punjab, and a Gold Medalist in her MPhil with a distinction in Research from Beaconhouse National University, Ms. Javaria Zahra has developed an indigenous ‘Learning Disabilities Scale (LDS)’ for Pakistan’s primary school children.

Ms. Javaria Zahra started off her career as a Consultant Psychologist for SOS Village Lahore, further on joining a number of universities as Lecturer and Assistant Professor respectively. Her dream of running a School and Academy came true and, with the help of FWBL, she opened up the High Achievement Institution in Lahore. Now she has started admissions from Class I till Class X (Matric), with more than 45 student enrollments.

Ms. Javaria Zahra shares with great joy, “I had always dreamed of running my own School and Academy where students are the first priority. Today, it is a reality.” “Knowledge is power, but real power is rooted in education,” she said.

Ms. Huma Seerat, a Diploma holder from National Institute of Health Islamabad, established the ‘Prime Clinical Laboratory’ in Multan. The clinical laboratory is equipped with all the necessary equipment and facilities to examine and conduct different types of tests.

Now Ms. Seerat is running her business successfully and has created employment opportunities for 4 more people. In only a short time, her laboratory has managed to increase its strong presence in the vicinity.

Ms. Khalida Gufran has had extensive experience in skillfully running a handicraft business from her residence over the years, as she acquired different skills’ trainings from renowned institutes in the areas of paintings, hand/machine knitting, cutting & tailoring, wood work, flower making and leather work.

In 2014, Ms. Khalida approached the FWBL Hyderabad Branch for a credit facility under PMYBL to formally set up a handicraft business. With the help of the financing extended to her, she was able to successfully set up her shop ‘Hayan Halla Handicrafts’ where a variety of handicraft items are available including painted pottery, purses, bags, colorful fancy mirrors & embroidery works.

She is content with the flourishing position of her business and, with the passage of time, has become financially sound.

Kaneez Bibi is running a shop of ladies’ stitched and unstitched clothes in Islamabad. She availed the PM’s Youth Business Loan (PMYBL) in January 2017. Earlier, she used to sell unstitched fabric and apparel, as well as design and stitch ladies dresses at home. She always dreamed of establishing her own business selling a variety of unstitched fabric for women, purchasing in bulk from Faisalabad. With FWBL’s PMYBL facility, she was able to achieve her ambition and formally establish the business. She utilized the loan amount to open her own shop and bought stock in bulk. Her life has changed from earning a nominal income to enjoying sustainable monthly earnings to support her family. Ms. Kaneez is happy with the progress of her business and plans to grow it further.

Mr. Tahir Ayub is a resident of Islamabad, running a small business of traditional Pakistani shoes (Khussas and Chappals). Like many small business owners, Mr. Ayub also aspired for a long time to grow his business and provide custom-made, high quality, soft leather Khussas. In order to achieve this, he approached FWBL to avail the PM’s Youth Business Loans to meet his financial short comings. After disbursement of the loan, he purchased high quality soft leather, and hired two trained female workers from Sahiwal and Multan. The workers are well aware of current market trends, and are helping make good quality and stylish handmade customized shoes (Khussas and Chappals) for customers. While earning good profit, Mr. Ayub is running a successful business with a vast variety of products.

Ms. Farzana Kousar lives in a joint family. Her husband used to drive a rickshaw, and the total monthly household income was insufficient to fulfill her dreams to educate her children and improve their quality of life. One day, Ms. Kousar decided to start her own business; she has a strong business sense as well as a strong will to achieve her dream. With the help of her husband and her own small savings, she opened a small Karyana and General Store. Initially, two shops were obtained on rent and a few grocery items were purchased. Later, Ms. Kousar approached FWBL to avail a credit facility under PMYBL. With this loan amount, she bought a variety of grocery products, biscuits, chips, drinks and other general items to sell. Shortly, she started to generate good earnings to meet her expenses. Today, she is a successful woman entrepreneur who continues to think on business lines, and looks forward to further enhancing and expanding her business. For Ms. Farzana Kousar, her bigger achievement is that all her children now go to school and she is able to easily fulfill their needs. Ms. Kousar’s initiative has not only improved the economic condition of her household, but also empowered her by providing an ongoing earning and social status in her family and society. She has also created one job opportunity. “FWBL empowered me, and I am empowering my family,” she says.

Ms. Noreen Ihsan is associated with the business of selling school uniforms since 2014. She runs a shop named ‘Master School Uniforms’. In order to expand her existing business and move to the next level, she needed a loan to cater to the increasing demands of her customers. She contacted FWBL to expand her business and, after availing the loan, has been able to create job opportunities for 6 more people. She is happy with the progress of her business, generating good income and enjoys a good business reputation in the locality.

Corporate Finance

Zehra Ashraf and Ashraf Mehmood – City Textiles

Zehra Ashraf and Ashraf Mehmood Eighteen years ago, City Textiles (Pvt) Ltd. came into existence as a fledgling company with limited resources and production power. When Zehra Ashhraf joined her husband, Mehmood Ashraf, in managing the business, they had little more than few spinning & textile units only enough to achieve a capacity of 30 bags of yarn and a production rate of 200 tents per day. Today, Chief Executive of the company Mr. Ashraf Mahmood, holds key positions in various trade unions within Pakistan and also holds the prestigious title of Vice Chairman in the Pakistan Canvas Tents Manufacturers & Exporters Association.

Mr. Mehmood and his wife have led City Textiles to become the 3rd most successful exporter in the country, engaging in the export of tents, tarpaulin, yarn, canvas materials and Allied products, with a major area of exports in military and disaster relief programs. They have also also received the prestigious ISO 9001:2000 certification. With the addition of numerous established textile and spinning units in their inventory, the company now has the capacity for 500 bags and ability to produce 1000 tents per day.

To date, City Textiles has achieved impressive supply targets for both military and emergency relief programs. Furthermore, they continue to supply tents to various parts of the world via direct Air Charter Flights out of Lahore. Some of these distribution missions have included supplying tents to the US troops and civilian refugees in Afghanistan, the Middle East and Indonesia for the last two decades.

City Textiles was awarded the 3rd Position amongst the Canvas and Tent exporters in 1999. Zehra Ashraf speaks highly of her association with FWBL: “FWBL was always there to cater to our requirements whether on a large or small scale”.

Micro Finance

Micro Finance Success Stories

Bushra Bibi is a resident of Village Ladhay Wala Warraich, District Gujranwala. Due to poor economic conditions of the village, women actively help their male counterparts in earning livelihoods for their respective families. Most women in the village were trained in packing fabric napkins but because of lack of monetary resources were unable to purchase raw material (fabric).

Bushra Bibi is a resident of Village Ladhay Wala Warraich, District Gujranwala. Due to poor economic conditions of the village, women actively help their male counterparts in earning livelihoods for their respective families. Most women in the village were trained in packing fabric napkins but because of lack of monetary resources were unable to purchase raw material (fabric).

Bushra applied and was granted a loan of Rs. 8,000 that she invested to purchase fabric for manufacturing napkins. Her business started growing and her major clients were hotels in Gujranwala. She would earn a profit of Rs. 75 per kg and a sale of an average 200 packets a month resulted in a handsome monthly income that helped her improve the financial conditions of her family.

Her future plan is to purchase a cutting machine to reduce the material costs and to expand her business by launching a retail outlet at her place. She also aspires to involve her fellow village women for the packaging of napkins.

When it comes to banking needs, Najeeba has always relied on FWBL. She says, “First Women Bank Ltd. has always been there to help me meet my growing business requirements”.

Farida belongs to the village of Ladhay Wala Warraich in Gujranwala. She has 5 daughters and 3 sons. Till 2002, her family’s living condition was not good as her husband was unemployed. Farida first took a loan from FWBL in 2002 and started a tea shop business which failed and she had to close it down. She and her husband then decided to start the business of formal dresses and market them in Sialkot. The reason why they chose Sialkot was because they believed that in Gujranwala they can only manage to sell in peak times and in off season i.e. off marriage season, their work is not in demand, whereas in Sialkot their work is bought throughout the year.

Farida belongs to the village of Ladhay Wala Warraich in Gujranwala. She has 5 daughters and 3 sons. Till 2002, her family’s living condition was not good as her husband was unemployed. Farida first took a loan from FWBL in 2002 and started a tea shop business which failed and she had to close it down. She and her husband then decided to start the business of formal dresses and market them in Sialkot. The reason why they chose Sialkot was because they believed that in Gujranwala they can only manage to sell in peak times and in off season i.e. off marriage season, their work is not in demand, whereas in Sialkot their work is bought throughout the year.

Farida’s monthly income is now Rs. 30,000 and she earns a profit of 200% on bridal dresses. She believes she can increase her income if she has the resources to buy raw material in bulk.

Despite her initial failure, FWBL kept faith in her abilities and disbursed another loan to her. Farida says that availability of finances always poses a challenge and FWBL has always been there to help her out.

Recipient of Citi PPAF Micro-Entrepreneurship Award 2008

Recipient of Citi PPAF Micro-Entrepreneurship Award 2008

Kubra Asghar comes from a family of 2 brothers and 2 sisters. Her parents lived in Farooqabad, where her father is an agriculturist. He always encouraged his daughters as much as his sons to pursue a career of their choice.

In 1997, she did her Lady Health Worker course after completing matriculation. During her field visits she saw the potential for embroidery done by the women at household level. She recommended few alterations in design to one of the middle women, who eventually proved to be her mentor. This lady gave her 5 suits to design as a challenge and hence began the journey. She was directly introduced to the buyers of the Sheikhupura and Lahore markets for whom she continued work for 2 years until she got married and moved with her in-laws. Initially her husband was opposed to the idea of her work but later allowed her to pursue her interest. As her business grew, so did her husband’s encouragement.

Kubra now owns an independent house which is in her own name. She shares this house with her sister. Beside being able to involve her younger sister, who is now married, she has provided employment to many housewives of her area. Kubra is an example of a vibrant empowered woman who plans to take her work to the International level, now that she has already reached out from rural to urban areas of Lahore and Karachi.

Kubra believes in constant learning of new trends and designs. Coming from a rural area she aims to give competition to the high-class designers of Lahore and Karachi. Kubra’s innovative and business mindedness can be gauged from the fact that she rents out bridal dresses on Rs. 2000 per day, and charges for any extra day. On average Kubra’s work generates revenues of Rs. 125,000 per month and her profit margin on average is 35%.

FWBL exhibited ‘Kubra’s Collection’ on 24th September, 2008, and received a very positive response. It was one of the most popular exhibitions at FWBL as the dresses were in price ranges easily affordable by working women. After availing 2 loans in the Microfinance category to meet specific client orders from Karachi and Lahore, Kubra is now negotiating an SME loan with FWBL.

Mumtaz Begum belongs to a community of carpet weavers from the village Kalaskay, District of Gujranwala. Her husband is a daily wage earner. Her household was solely dependent on his daily wages, which were not sufficient to fulfill her wish to educate her child and maintain a good living standard for her family. Their total monthly earnings were Rs. 3000. Despite initial resistance from her husband, she decided to open a small grocery store in a room of her house with financial support from FWBL.

Mumtaz Begum belongs to a community of carpet weavers from the village Kalaskay, District of Gujranwala. Her husband is a daily wage earner. Her household was solely dependent on his daily wages, which were not sufficient to fulfill her wish to educate her child and maintain a good living standard for her family. Their total monthly earnings were Rs. 3000. Despite initial resistance from her husband, she decided to open a small grocery store in a room of her house with financial support from FWBL.

She took her 1st loan from FWBL to install a cone ice cream machine at her home. Following the success of this venture, she opened a small retail shop at the backdoor of her small house from the 2nd loan that she availed. FWBL supported her again when she applied for a 3rd loan through which she bought a deep freezer. She has transformed into an entrepreneurial woman who keeps thinking on business lines, constantly on the lookout to further enhance and expand her retail shop and FWBL has supported her all the way through.

Currently her monthly income is Rs. 9000. For Mumtaz Bibi, her bigger achievement is that her daughter is now going to school. Mumtaz’s initiative is not only to improve the economic condition of her household, but also empowered her by providing her a greater social status in the family and village. She says, “FWBL gave me the power to succeed”.

Naseem Bibi is resident of a small village In District Gujranwala. She has two sons and three daughters. Her husband is a daily wage earner. Although it was deemed impossible for her to raise her children, and at the same time, assist her husband in generating additional income for their household; but she has proven everyone wrong by successfully managing to fulfill her dual role and contributing in her family’s economic independence.

Naseem Bibi is resident of a small village In District Gujranwala. She has two sons and three daughters. Her husband is a daily wage earner. Although it was deemed impossible for her to raise her children, and at the same time, assist her husband in generating additional income for their household; but she has proven everyone wrong by successfully managing to fulfill her dual role and contributing in her family’s economic independence.

“I availed a micro loan of Rs. 10,000 from First Women Bank Limited to purchase sewing machines for my home based stitching center. This increased my monthly income from Rs. 3000 to 5000 and helped me send my children to school. I fully repaid the loan and purchased another embroidery machine from savings. Now my monthly income has reached Rs. 8000.”

“This financial turnaround has helped me to achieve a very respectable place in my family and society. Not only have I benefited my family but also imparted my skills to about 35 to 40 of my apprentices from the village, some of whom have already followed In my footsteps and applied for microloans from FWBL. I have also sought another loan from which I will purchase more machines and designing material.”

Nasim Bibi, a mother of 4 children is a resident of Farooqabad. Her husband’s daily wages were not enough to meet the family’s needs. Ten years ago he started making cushions and foam pillows at a very low scale to make ends meet. But due to insufficient working capital he wasn’t able to expand his business. Nasim, shelving aside all her inhibitions regarding credit financing, sought a loan of Rs. 10,000 from First Women Bank Limited and used it to purchase raw material for her husband’s business. As a result their monthly income rose by Rs. 2,000 a month. Upon repayment of the first loan, she availed a second loan of Rs. 20,000, which the couple used to rent out a three Marla house for expanding their business. Their trade has flourished since then and they have started making Rs. 12,000 a month. Three of their children are enrolled in school while the elder one is helping them in their business.

Nasim Bibi, a mother of 4 children is a resident of Farooqabad. Her husband’s daily wages were not enough to meet the family’s needs. Ten years ago he started making cushions and foam pillows at a very low scale to make ends meet. But due to insufficient working capital he wasn’t able to expand his business. Nasim, shelving aside all her inhibitions regarding credit financing, sought a loan of Rs. 10,000 from First Women Bank Limited and used it to purchase raw material for her husband’s business. As a result their monthly income rose by Rs. 2,000 a month. Upon repayment of the first loan, she availed a second loan of Rs. 20,000, which the couple used to rent out a three Marla house for expanding their business. Their trade has flourished since then and they have started making Rs. 12,000 a month. Three of their children are enrolled in school while the elder one is helping them in their business.

In 2005, Nasim Bibi was among 16 successful micro-entrepreneurs who were conferred “Global Micro-Entrepreneurship Award” organized by the UN Capital Development Fund in collaboration with CITI Group Foundation, Harvard Business School and Pakistan Poverty Alleviation Fund.

Ruqia is from Nokhar village in Sheikhupura. She has 5 daughters and 2 sons, all of whom go to school. Ruqia has been running her apparel business for quite some time now. She trains her apprentices who in return do her work, free of cost. She claims her profit margin to be almost 100% and her average monthly income is Rs. 12,000/-. A wedding dress that she recently made cost her Rs. 3500/- and she managed to sell it for Rs. 6000/-. Her clientele is mostly affluent individuals from urban Sheikhupura.

Ruqia is from Nokhar village in Sheikhupura. She has 5 daughters and 2 sons, all of whom go to school. Ruqia has been running her apparel business for quite some time now. She trains her apprentices who in return do her work, free of cost. She claims her profit margin to be almost 100% and her average monthly income is Rs. 12,000/-. A wedding dress that she recently made cost her Rs. 3500/- and she managed to sell it for Rs. 6000/-. Her clientele is mostly affluent individuals from urban Sheikhupura.

Ruqia has availed 3 loans from FWBL and waits for a 4th one to be sanctioned. She attributes her success to the timely disbursal of funds by FWBL. Previously she was only able to take one 1 or 2 orders. But now, having been financially empowered by FWBL, she on average handles 9-10 orders at a time. She plans to continue expanding her business with support from FWBL.

- December 4, 2008

- November 19, 2008

- Clinton Global Initiative 2008

- First Women Bank Ltd. and Depilex Smile again join hands

- Ms. Nilofar Bakhtiar, Advisor to the Prime Minister and Minister in-charge Ministry of Women Development

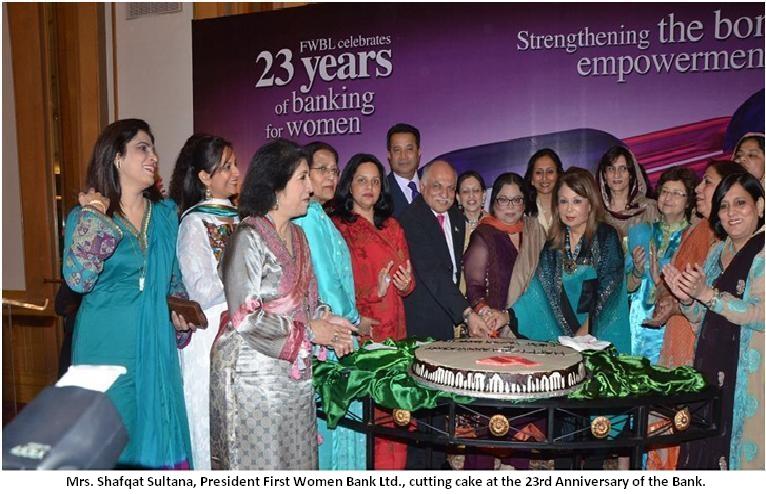

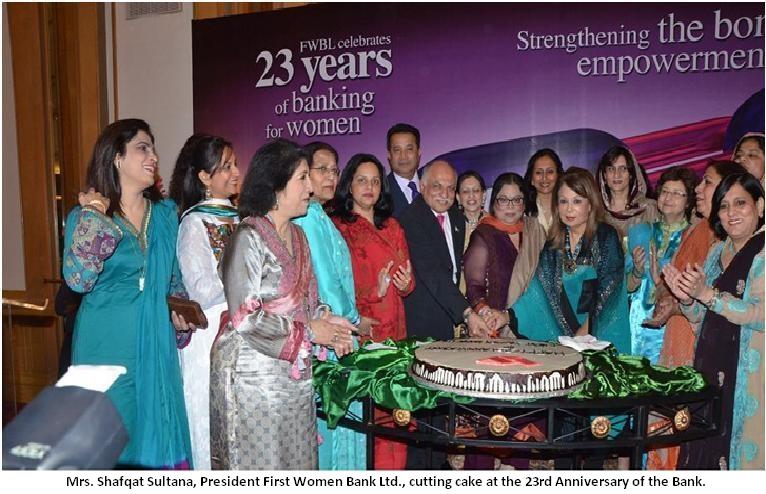

- The 16th Annual Conference of First Women Bank Ltd. was held on Monday at the Hotel Pearl Continental Karachi

- Ms. Zarine Aziz , First Women Bank Ltd. called on Dr. Salman Shah, Adviser to the Prime Minister on Finance

-

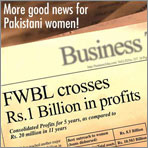

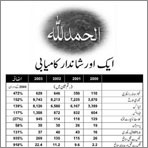

First Women Bank Ltd. net profit has crossed to Rs. 1.8 billion in

the last five and half years as compared to the profits of Rs. 20 million

for the last 11 years - Ms. Aziz addressed the conference ‘Women in Power’ titled “Blazing New Trails” held in Kuala Lumpur, Malaysia. The conference was organized by Intelligence Business Networks (IBN) in commemoration with International Women’s Day.

- December 2, 2008

- July 23, 2008

- PACRA upgrades the ratings of First Women Bank Ltd. (FWBL)

- Ms. Zarine Aziz president FWBL address at international conference at Dhaka

- Ms. Zarine Aziz, President. performed the computerised Hajj balloting at the Head Office

- Ms. Zarine Aziz President First Women Bank Ltd., keynote speaker of the Business Breakfast at the Institute of Bankers

- Ms. Aziz, during her visit to Grameen Bank, Dhaka met Prof Dr. Muhammad Younus.

- Ms. Fatima Rafsanjani visited FWBL Head Office and met the President of the Bank. Iranian delegation has shown keen interest in replicating FWBL’s model in Iran.

- Ms. Zarine Aziz President First Women Bank Ltd. represented Pakistan as speaker at a two-day conference Women in Power 2006 titled 'Blazing New Trails' held in Kuala Lumpur, Malaysia

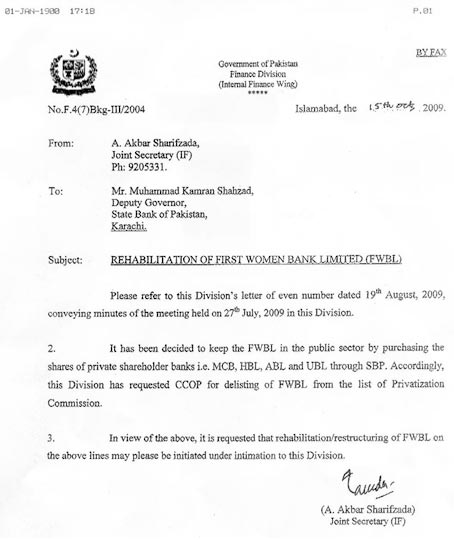

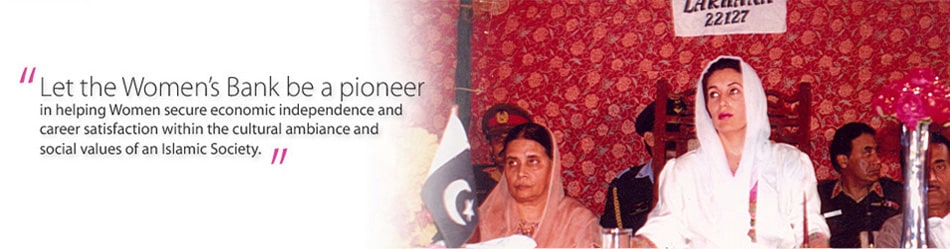

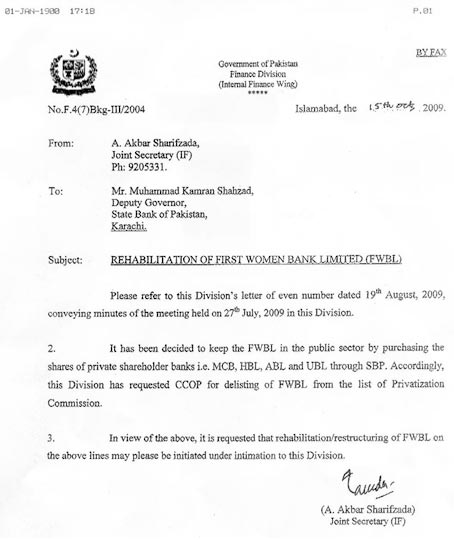

Rehabilitation of FWBL by the Government of Pakistan

- Collaborations

- Photo Gallery

- Advertisement

- Newsletter

- Audio & Video

- SUCCESS STORIES

- Special Reports

- Press Clipping

- Media Releases

- Rehabilitation

National

International

- Newsletter in the PDF format [January 2022 to June 2022]

- Newsletter in the PDF format [October 2020 to March 2021]

- Newsletter in the PDF format [January to March 2020]

- Newsletter in the PDF format [July to September 2019]

- Newsletter in the PDF format [January to March 2019]

- Newsletter in the PDF format [April to June 2018]

- Newsletter in the PDF format [October to December 2017]

- Newsletter in the PDF format [April to June 2017]

- Newsletter in the PDF format [October to December 2016]

- Newsletter in the PDF format [April to June 2016]]

- Newsletter in the PDF format [October to December 2015]

- Newsletter in the PDF format [April to June 2015]

- Newsletter in the PDF format [October to December 2014]

- Newsletter in the PDF format [April to June 2014]

- Newsletter in the PDF format [October to December 2013]

- Newsletter in the PDF format [April to June 2013]

- Newsletter in the PDF format [October to December 2012]

- Newsletter in the PDF format [April to June 2012]

- Newsletter in the PDF format [October to December 2011]

- Newsletter in the PDF format [April to June 2011]

- Newsletter in the PDF format [April 2021 to September 2021]

- Newsletter in the PDF format [April to September 2020]

- Newsletter in the PDF format [October to December 2019]

- Newsletter in the PDF format [April to June 2019]

- Newsletter in the PDF format [July to December 2018]

- Newsletter in the PDF format [January to March 2018]

- Newsletter in the PDF format [July to September 2017]

- Newsletter in the PDF format [January to March 2017]

- Newsletter in the PDF format [July to September 2016]

- Newsletter in the PDF format [January to March 2016]

- Newsletter in the PDF format [July to September 2015]

- Newsletter in the PDF format [January to March 2015]

- Newsletter in the PDF format [July to September 2014]

- Newsletter in the PDF format [January to March 2014]

- Newsletter in the PDF format [July to September 2013]

- Newsletter in the PDF format [January to March 2013]

- Newsletter in the PDF format [July to September 2012]

- Newsletter in the PDF format [January to March 2012]

- Newsletter in the PDF format [July to September 2011]

- Newsletter in the PDF format [January to March 2011]

AUDIO

Video

SME Finance

Najeeba Zulfiqar (Bee Gee) is one of the most well-known designers in the fashion industry. She has been designing dresses for popular film and TV stars for many years now. She started her business back in 1985 and has come a long way since. Having firmly established herself in the local fashion industry, she expanded her horizon and went global, winning critics’ accolades at various international fashion shows and exhibitions across the world. Bee Gee designs all kinds of dresses – from bridal, formal, casual to party wear, costumes for films, dramas, etc. She enjoys a loyal customer base in Pakistan, UK, USA, Canada and India.

Najeeba Zulfiqar (Bee Gee) is one of the most well-known designers in the fashion industry. She has been designing dresses for popular film and TV stars for many years now. She started her business back in 1985 and has come a long way since. Having firmly established herself in the local fashion industry, she expanded her horizon and went global, winning critics’ accolades at various international fashion shows and exhibitions across the world. Bee Gee designs all kinds of dresses – from bridal, formal, casual to party wear, costumes for films, dramas, etc. She enjoys a loyal customer base in Pakistan, UK, USA, Canada and India.

When it comes to banking needs, Najeeba has always relied on FWBL. She says, “First Women Bank Ltd. has always been there to help me meet my growing business requirements”.

Beo Zafar is a poet, writer, TV anchor, comedian and business woman.

Beo Zafar is a poet, writer, TV anchor, comedian and business woman.

Possessing such a multifaceted personality, it’s not surprising to see where Beo stands today. Running a very successful salon business in Karachi for almost 8 years now, Beo decided to venture into arts and literature, when she and her dear friend and painter Tabinda Chinoy launched a poems and paintings book by the name of “The Dreamer Awakens”. Beo says, “This collection of poems is what I managed to salvage (of my random writings) when I decided to publish, and it was only then that I noticed a common strain running through almost all of them: the urge to move from duality to oneness”. Ever since Beo opened her salon in Karachi, she has been banking with FWBL. And once again with the launch of her book, she has found us to be an ever-reliable partner.

Tabinda Chinoy is an artist and sculptor and has held solo and group shows in leading galleries internationally. She is a Director of the Central Institute of Arts and Crafts, Karachi and gives art appreciation lectures at the Aga Khan University, Karachi. Nagi, one of Pakistan’s senior-most artists introduced her to art when he asked her to paint in the vast basement studio of his house alongside some of Pakistan’s all time greats, Ahmed Parvez and Bashir Mirza. She and Beo Zafar recently launched their book “The Dreamer Awakens”. In the words of Tabinda, As for this book, it was an amazing connection. We were stunned to discover when we put our work together, that the poems were as much my journey as they were Beo’s; mine expressed in paint, hers in verse, but speaking the same language.

Tabinda Chinoy is an artist and sculptor and has held solo and group shows in leading galleries internationally. She is a Director of the Central Institute of Arts and Crafts, Karachi and gives art appreciation lectures at the Aga Khan University, Karachi. Nagi, one of Pakistan’s senior-most artists introduced her to art when he asked her to paint in the vast basement studio of his house alongside some of Pakistan’s all time greats, Ahmed Parvez and Bashir Mirza. She and Beo Zafar recently launched their book “The Dreamer Awakens”. In the words of Tabinda, As for this book, it was an amazing connection. We were stunned to discover when we put our work together, that the poems were as much my journey as they were Beo’s; mine expressed in paint, hers in verse, but speaking the same language.

As we proceeded matching poem to painting, we realized with awe that a book was being born.

Ms. Ruth Paul is a foreign qualified beautician who has been in this industry since 1982. On her return from London, where she had gone to do courses in beautician training, she started her own enterprise. At that time, she had a savings account with FWBL. Her association with the bank was further strengthened when she decided to apply for a loan to expand her business.

Ms. Ruth Paul is a foreign qualified beautician who has been in this industry since 1982. On her return from London, where she had gone to do courses in beautician training, she started her own enterprise. At that time, she had a savings account with FWBL. Her association with the bank was further strengthened when she decided to apply for a loan to expand her business.

All the equipment required for her business was imported from Dubai. Ruth believes that her talent and hard work have been augmented by the loan she acquired from FWBL. “It has helped me double my skills and commitment. Being a single woman with no family support, I am grateful to FWBL for helping me stand on my own feet”.

Her loan tenor finishes in June and she intends to seek more financing from FWBL to help her set up a health center. Never say die has been her motto in life that has helped her become such a successful woman entrepreneur.

Dr. Tanveer is a medical doctor by profession and has specialized in radiology and ultrasound. She established her own clinic 17 years back through FWBL’s credit financing facility. Hailing from a conservative background, she has defied societal norms by setting up her own business countering resistance from various quarters.

Dr. Tanveer is a medical doctor by profession and has specialized in radiology and ultrasound. She established her own clinic 17 years back through FWBL’s credit financing facility. Hailing from a conservative background, she has defied societal norms by setting up her own business countering resistance from various quarters.

She has always had a passion to excel in this particular field. To her, ultrasound is the most important part of treatment of ailments as it involves diagnosis of the patient, helping the physician understand where the problem actually lies.

Ultrasound machinery and equipment is quite expensive and technological advancement in this field calls for constant upgradation. FWBL has always been her solution whenever she has been in need of capital to upgrade her setup.

As the field of ultrasound continues to make rapid advancements, Dr. Tanveer realizes that her setup would constantly need to respond to the technological changes. In FWBL, she knows she has a reliable partner who will always be there to help her.

PMYBL Success Stories

Mrs. Jamala Gul Nigar belongs to the village Ismaila District Sawabi, with a keen interest in growing unseasonal vegetables. Taking the first step to pursue her passion, she applied for the Prime Minister’s Youth Business Loan (PMYBL) through First Women Bank Limited (FWBL) to start her own business. After availing the loan, she fully utilized the land to optimize her resources and cultivate the crop, while creating employment opportunities for 9 people.

Mrs. Jamala Gul Nigar sold the first crop of cabbage 5 months ago and received a very good response from the market. Now she is optimistic about her tomato and potato crops which are being cultivated. Mrs. Nigar is very satisfied and happy with the flourishing position of her business.

Ms. Madeeha Nasir applied to the PM’s Youth Business Loan through FWBL to open a boutique. She was amongst the successful candidates of PMYBL’s 2nd balloting and was provided with the loan in July 2014.

Within a short span of 5 months after starting her business, this young and energetic lady managed to properly set up a boutique at her residence in Satellite Town, Rawalpindi. She has also engaged 1 helper and 3 tailors.

Ms. Nasir started earning profits from her business by making focused marketing efforts in the neighbouring areas where a large number of girls’ colleges and hostels are located.

Ms. Wajeeha Ishaq is another successful applicant of the PM’s Youth Business Loans’ 1st balloting result.

The loan amount was disbursed in March 2014, and from there on she never looked back. Within 10 months, she started a day care centre along with her patron, Mrs. Shahnaz, who is managing the Montessori school run on the ground floor. The day care centre is established on the first floor so that the babies don’t get disturbed by the toddlers studying at the school.

Currently, Aagosh Montessori & Day Care Centre has 6 babies enrolled in the day care centre, and is expecting new admissions as more parents are enquiring about the details.

Ms. Wajeeha is happy with her business and plans to expand it further.

Ms. Nadia Zeb is also one of the PM’s Youth Business Loan Program beneficiaries. Prior to availing the loan, Ms. Nadia was managing her husband’s utility store franchise in Rawalpindi with limited products to offer.

In order to meet the growing customer demand of a variety of products, she applied for PM’s Youth Business Loan. The loan was disbursed to Ms. Nadia Zeb in April 2014.

She utilized it for purchasing a stock of different products in bulk and opened a superstore through which Ms. Nadia has created an employment opportunity for one more person on a monthly salary basis. Ms. Nadia mentioned that her business has flourished exponentially after availing the PMYBL.

Ms. Roheena Ayub, the sole proprietor of Mehmoona Beauty Parlor, is a resident of Rawalpindi where she runs a beauty parlour, training centre and a ladies accessories’ shop on a small scale. She wanted financial assistance to revamp the parlor and enhance the services offered to her clients; she approached FWBL for the PM’s Youth Business Loan facility. After the disbursement of the loan, she purchased a wide range and stock of products, an LED TV and replaced the parlor’s cemented floor with tiles. With these changes, Ms. Roheena has witnessed progress in her business. Ms. Roheena outlines the positive impact of the PMYBL facility on her business. After receiving the loan, she has also been able to employ 2 people on a monthly salary basis.

A graduate from National College of Arts (NCA) (2013 batch), Ms. Xhura Hafeez availed a loan from FWBL and set up her door manufacturing business under the name of ‘DarSaaz’, with a focus on creative restoration. Ms. Hafeez’s concept is not just a business model; it truly represents bringing back the pride in products made in Pakistan.

The products produced by DarSaaz are handmade and crafted by local artisans. DarSaaz is currently operating from its office in Bani Gala, Islamabad. Ms. Hafeez is happy with the growth of her business, and is also making the effort to participate in various exhibitions.

Ms. Areeba Khan is another beneficiary of the PM’s Youth Business Loans. Inspired by her mother and aunt, both of whom have been related to the beauty salon business for the past 15 years, Ms. Areeba too wanted to establish her own beauty salon, for which she acquired formal training and worked three years at her mother’s salon.

After availing the loan in November 2016, Ms. Areeba established her beauty salon ‘Beauty Rays’ and provided employment opportunities to 4 people. She is quite satisfied by the pace of her business growth and plans to expand in the future.

Mrs. Farhana Abbas, an experienced beauty professional and owner of ‘Aleena Beauty Parlor’ in Gujranwala, availed a loan from FWBL for the expansion of her beauty parlor. With FWBL’s help, her parlor is now equipped with all the related tools and equipment.

She has created employment opportunities for 4 more people. She’s delighted to share that her business has flourished in leaps and bounds after availing the PMYBL.

With a Master’s of Science in Applied Psychology from University of Punjab, and a Gold Medalist in her MPhil with a distinction in Research from Beaconhouse National University, Ms. Javaria Zahra has developed an indigenous ‘Learning Disabilities Scale (LDS)’ for Pakistan’s primary school children.

Ms. Javaria Zahra started off her career as a Consultant Psychologist for SOS Village Lahore, further on joining a number of universities as Lecturer and Assistant Professor respectively. Her dream of running a School and Academy came true and, with the help of FWBL, she opened up the High Achievement Institution in Lahore. Now she has started admissions from Class I till Class X (Matric), with more than 45 student enrollments.

Ms. Javaria Zahra shares with great joy, “I had always dreamed of running my own School and Academy where students are the first priority. Today, it is a reality.” “Knowledge is power, but real power is rooted in education,” she said.

Ms. Huma Seerat, a Diploma holder from National Institute of Health Islamabad, established the ‘Prime Clinical Laboratory’ in Multan. The clinical laboratory is equipped with all the necessary equipment and facilities to examine and conduct different types of tests.

Now Ms. Seerat is running her business successfully and has created employment opportunities for 4 more people. In only a short time, her laboratory has managed to increase its strong presence in the vicinity.

Ms. Khalida Gufran has had extensive experience in skillfully running a handicraft business from her residence over the years, as she acquired different skills’ trainings from renowned institutes in the areas of paintings, hand/machine knitting, cutting & tailoring, wood work, flower making and leather work.

In 2014, Ms. Khalida approached the FWBL Hyderabad Branch for a credit facility under PMYBL to formally set up a handicraft business. With the help of the financing extended to her, she was able to successfully set up her shop ‘Hayan Halla Handicrafts’ where a variety of handicraft items are available including painted pottery, purses, bags, colorful fancy mirrors & embroidery works.

She is content with the flourishing position of her business and, with the passage of time, has become financially sound.

Kaneez Bibi is running a shop of ladies’ stitched and unstitched clothes in Islamabad. She availed the PM’s Youth Business Loan (PMYBL) in January 2017. Earlier, she used to sell unstitched fabric and apparel, as well as design and stitch ladies dresses at home. She always dreamed of establishing her own business selling a variety of unstitched fabric for women, purchasing in bulk from Faisalabad. With FWBL’s PMYBL facility, she was able to achieve her ambition and formally establish the business. She utilized the loan amount to open her own shop and bought stock in bulk. Her life has changed from earning a nominal income to enjoying sustainable monthly earnings to support her family. Ms. Kaneez is happy with the progress of her business and plans to grow it further.

Mr. Tahir Ayub is a resident of Islamabad, running a small business of traditional Pakistani shoes (Khussas and Chappals). Like many small business owners, Mr. Ayub also aspired for a long time to grow his business and provide custom-made, high quality, soft leather Khussas. In order to achieve this, he approached FWBL to avail the PM’s Youth Business Loans to meet his financial short comings. After disbursement of the loan, he purchased high quality soft leather, and hired two trained female workers from Sahiwal and Multan. The workers are well aware of current market trends, and are helping make good quality and stylish handmade customized shoes (Khussas and Chappals) for customers. While earning good profit, Mr. Ayub is running a successful business with a vast variety of products.

Ms. Farzana Kousar lives in a joint family. Her husband used to drive a rickshaw, and the total monthly household income was insufficient to fulfill her dreams to educate her children and improve their quality of life. One day, Ms. Kousar decided to start her own business; she has a strong business sense as well as a strong will to achieve her dream. With the help of her husband and her own small savings, she opened a small Karyana and General Store. Initially, two shops were obtained on rent and a few grocery items were purchased. Later, Ms. Kousar approached FWBL to avail a credit facility under PMYBL. With this loan amount, she bought a variety of grocery products, biscuits, chips, drinks and other general items to sell. Shortly, she started to generate good earnings to meet her expenses. Today, she is a successful woman entrepreneur who continues to think on business lines, and looks forward to further enhancing and expanding her business. For Ms. Farzana Kousar, her bigger achievement is that all her children now go to school and she is able to easily fulfill their needs. Ms. Kousar’s initiative has not only improved the economic condition of her household, but also empowered her by providing an ongoing earning and social status in her family and society. She has also created one job opportunity. “FWBL empowered me, and I am empowering my family,” she says.

Ms. Noreen Ihsan is associated with the business of selling school uniforms since 2014. She runs a shop named ‘Master School Uniforms’. In order to expand her existing business and move to the next level, she needed a loan to cater to the increasing demands of her customers. She contacted FWBL to expand her business and, after availing the loan, has been able to create job opportunities for 6 more people. She is happy with the progress of her business, generating good income and enjoys a good business reputation in the locality.

Corporate Finance

Zehra Ashraf and Ashraf Mehmood – City Textiles

Zehra Ashraf and Ashraf Mehmood Eighteen years ago, City Textiles (Pvt) Ltd. came into existence as a fledgling company with limited resources and production power. When Zehra Ashhraf joined her husband, Mehmood Ashraf, in managing the business, they had little more than few spinning & textile units only enough to achieve a capacity of 30 bags of yarn and a production rate of 200 tents per day. Today, Chief Executive of the company Mr. Ashraf Mahmood, holds key positions in various trade unions within Pakistan and also holds the prestigious title of Vice Chairman in the Pakistan Canvas Tents Manufacturers & Exporters Association.

Mr. Mehmood and his wife have led City Textiles to become the 3rd most successful exporter in the country, engaging in the export of tents, tarpaulin, yarn, canvas materials and Allied products, with a major area of exports in military and disaster relief programs. They have also also received the prestigious ISO 9001:2000 certification. With the addition of numerous established textile and spinning units in their inventory, the company now has the capacity for 500 bags and ability to produce 1000 tents per day.

To date, City Textiles has achieved impressive supply targets for both military and emergency relief programs. Furthermore, they continue to supply tents to various parts of the world via direct Air Charter Flights out of Lahore. Some of these distribution missions have included supplying tents to the US troops and civilian refugees in Afghanistan, the Middle East and Indonesia for the last two decades.

City Textiles was awarded the 3rd Position amongst the Canvas and Tent exporters in 1999. Zehra Ashraf speaks highly of her association with FWBL: “FWBL was always there to cater to our requirements whether on a large or small scale”.

Micro Finance

Micro Finance Success Stories

Bushra Bibi is a resident of Village Ladhay Wala Warraich, District Gujranwala. Due to poor economic conditions of the village, women actively help their male counterparts in earning livelihoods for their respective families. Most women in the village were trained in packing fabric napkins but because of lack of monetary resources were unable to purchase raw material (fabric).

Bushra Bibi is a resident of Village Ladhay Wala Warraich, District Gujranwala. Due to poor economic conditions of the village, women actively help their male counterparts in earning livelihoods for their respective families. Most women in the village were trained in packing fabric napkins but because of lack of monetary resources were unable to purchase raw material (fabric).

Bushra applied and was granted a loan of Rs. 8,000 that she invested to purchase fabric for manufacturing napkins. Her business started growing and her major clients were hotels in Gujranwala. She would earn a profit of Rs. 75 per kg and a sale of an average 200 packets a month resulted in a handsome monthly income that helped her improve the financial conditions of her family.

Her future plan is to purchase a cutting machine to reduce the material costs and to expand her business by launching a retail outlet at her place. She also aspires to involve her fellow village women for the packaging of napkins.

When it comes to banking needs, Najeeba has always relied on FWBL. She says, “First Women Bank Ltd. has always been there to help me meet my growing business requirements”.

Farida belongs to the village of Ladhay Wala Warraich in Gujranwala. She has 5 daughters and 3 sons. Till 2002, her family’s living condition was not good as her husband was unemployed. Farida first took a loan from FWBL in 2002 and started a tea shop business which failed and she had to close it down. She and her husband then decided to start the business of formal dresses and market them in Sialkot. The reason why they chose Sialkot was because they believed that in Gujranwala they can only manage to sell in peak times and in off season i.e. off marriage season, their work is not in demand, whereas in Sialkot their work is bought throughout the year.

Farida belongs to the village of Ladhay Wala Warraich in Gujranwala. She has 5 daughters and 3 sons. Till 2002, her family’s living condition was not good as her husband was unemployed. Farida first took a loan from FWBL in 2002 and started a tea shop business which failed and she had to close it down. She and her husband then decided to start the business of formal dresses and market them in Sialkot. The reason why they chose Sialkot was because they believed that in Gujranwala they can only manage to sell in peak times and in off season i.e. off marriage season, their work is not in demand, whereas in Sialkot their work is bought throughout the year.

Farida’s monthly income is now Rs. 30,000 and she earns a profit of 200% on bridal dresses. She believes she can increase her income if she has the resources to buy raw material in bulk.

Despite her initial failure, FWBL kept faith in her abilities and disbursed another loan to her. Farida says that availability of finances always poses a challenge and FWBL has always been there to help her out.

Recipient of Citi PPAF Micro-Entrepreneurship Award 2008

Recipient of Citi PPAF Micro-Entrepreneurship Award 2008

Kubra Asghar comes from a family of 2 brothers and 2 sisters. Her parents lived in Farooqabad, where her father is an agriculturist. He always encouraged his daughters as much as his sons to pursue a career of their choice.

In 1997, she did her Lady Health Worker course after completing matriculation. During her field visits she saw the potential for embroidery done by the women at household level. She recommended few alterations in design to one of the middle women, who eventually proved to be her mentor. This lady gave her 5 suits to design as a challenge and hence began the journey. She was directly introduced to the buyers of the Sheikhupura and Lahore markets for whom she continued work for 2 years until she got married and moved with her in-laws. Initially her husband was opposed to the idea of her work but later allowed her to pursue her interest. As her business grew, so did her husband’s encouragement.

Kubra now owns an independent house which is in her own name. She shares this house with her sister. Beside being able to involve her younger sister, who is now married, she has provided employment to many housewives of her area. Kubra is an example of a vibrant empowered woman who plans to take her work to the International level, now that she has already reached out from rural to urban areas of Lahore and Karachi.

Kubra believes in constant learning of new trends and designs. Coming from a rural area she aims to give competition to the high-class designers of Lahore and Karachi. Kubra’s innovative and business mindedness can be gauged from the fact that she rents out bridal dresses on Rs. 2000 per day, and charges for any extra day. On average Kubra’s work generates revenues of Rs. 125,000 per month and her profit margin on average is 35%.

FWBL exhibited ‘Kubra’s Collection’ on 24th September, 2008, and received a very positive response. It was one of the most popular exhibitions at FWBL as the dresses were in price ranges easily affordable by working women. After availing 2 loans in the Microfinance category to meet specific client orders from Karachi and Lahore, Kubra is now negotiating an SME loan with FWBL.

Mumtaz Begum belongs to a community of carpet weavers from the village Kalaskay, District of Gujranwala. Her husband is a daily wage earner. Her household was solely dependent on his daily wages, which were not sufficient to fulfill her wish to educate her child and maintain a good living standard for her family. Their total monthly earnings were Rs. 3000. Despite initial resistance from her husband, she decided to open a small grocery store in a room of her house with financial support from FWBL.

Mumtaz Begum belongs to a community of carpet weavers from the village Kalaskay, District of Gujranwala. Her husband is a daily wage earner. Her household was solely dependent on his daily wages, which were not sufficient to fulfill her wish to educate her child and maintain a good living standard for her family. Their total monthly earnings were Rs. 3000. Despite initial resistance from her husband, she decided to open a small grocery store in a room of her house with financial support from FWBL.

She took her 1st loan from FWBL to install a cone ice cream machine at her home. Following the success of this venture, she opened a small retail shop at the backdoor of her small house from the 2nd loan that she availed. FWBL supported her again when she applied for a 3rd loan through which she bought a deep freezer. She has transformed into an entrepreneurial woman who keeps thinking on business lines, constantly on the lookout to further enhance and expand her retail shop and FWBL has supported her all the way through.

Currently her monthly income is Rs. 9000. For Mumtaz Bibi, her bigger achievement is that her daughter is now going to school. Mumtaz’s initiative is not only to improve the economic condition of her household, but also empowered her by providing her a greater social status in the family and village. She says, “FWBL gave me the power to succeed”.

Naseem Bibi is resident of a small village In District Gujranwala. She has two sons and three daughters. Her husband is a daily wage earner. Although it was deemed impossible for her to raise her children, and at the same time, assist her husband in generating additional income for their household; but she has proven everyone wrong by successfully managing to fulfill her dual role and contributing in her family’s economic independence.

Naseem Bibi is resident of a small village In District Gujranwala. She has two sons and three daughters. Her husband is a daily wage earner. Although it was deemed impossible for her to raise her children, and at the same time, assist her husband in generating additional income for their household; but she has proven everyone wrong by successfully managing to fulfill her dual role and contributing in her family’s economic independence.

“I availed a micro loan of Rs. 10,000 from First Women Bank Limited to purchase sewing machines for my home based stitching center. This increased my monthly income from Rs. 3000 to 5000 and helped me send my children to school. I fully repaid the loan and purchased another embroidery machine from savings. Now my monthly income has reached Rs. 8000.”

“This financial turnaround has helped me to achieve a very respectable place in my family and society. Not only have I benefited my family but also imparted my skills to about 35 to 40 of my apprentices from the village, some of whom have already followed In my footsteps and applied for microloans from FWBL. I have also sought another loan from which I will purchase more machines and designing material.”

Nasim Bibi, a mother of 4 children is a resident of Farooqabad. Her husband’s daily wages were not enough to meet the family’s needs. Ten years ago he started making cushions and foam pillows at a very low scale to make ends meet. But due to insufficient working capital he wasn’t able to expand his business. Nasim, shelving aside all her inhibitions regarding credit financing, sought a loan of Rs. 10,000 from First Women Bank Limited and used it to purchase raw material for her husband’s business. As a result their monthly income rose by Rs. 2,000 a month. Upon repayment of the first loan, she availed a second loan of Rs. 20,000, which the couple used to rent out a three Marla house for expanding their business. Their trade has flourished since then and they have started making Rs. 12,000 a month. Three of their children are enrolled in school while the elder one is helping them in their business.

Nasim Bibi, a mother of 4 children is a resident of Farooqabad. Her husband’s daily wages were not enough to meet the family’s needs. Ten years ago he started making cushions and foam pillows at a very low scale to make ends meet. But due to insufficient working capital he wasn’t able to expand his business. Nasim, shelving aside all her inhibitions regarding credit financing, sought a loan of Rs. 10,000 from First Women Bank Limited and used it to purchase raw material for her husband’s business. As a result their monthly income rose by Rs. 2,000 a month. Upon repayment of the first loan, she availed a second loan of Rs. 20,000, which the couple used to rent out a three Marla house for expanding their business. Their trade has flourished since then and they have started making Rs. 12,000 a month. Three of their children are enrolled in school while the elder one is helping them in their business.

In 2005, Nasim Bibi was among 16 successful micro-entrepreneurs who were conferred “Global Micro-Entrepreneurship Award” organized by the UN Capital Development Fund in collaboration with CITI Group Foundation, Harvard Business School and Pakistan Poverty Alleviation Fund.

Ruqia is from Nokhar village in Sheikhupura. She has 5 daughters and 2 sons, all of whom go to school. Ruqia has been running her apparel business for quite some time now. She trains her apprentices who in return do her work, free of cost. She claims her profit margin to be almost 100% and her average monthly income is Rs. 12,000/-. A wedding dress that she recently made cost her Rs. 3500/- and she managed to sell it for Rs. 6000/-. Her clientele is mostly affluent individuals from urban Sheikhupura.

Ruqia is from Nokhar village in Sheikhupura. She has 5 daughters and 2 sons, all of whom go to school. Ruqia has been running her apparel business for quite some time now. She trains her apprentices who in return do her work, free of cost. She claims her profit margin to be almost 100% and her average monthly income is Rs. 12,000/-. A wedding dress that she recently made cost her Rs. 3500/- and she managed to sell it for Rs. 6000/-. Her clientele is mostly affluent individuals from urban Sheikhupura.

Ruqia has availed 3 loans from FWBL and waits for a 4th one to be sanctioned. She attributes her success to the timely disbursal of funds by FWBL. Previously she was only able to take one 1 or 2 orders. But now, having been financially empowered by FWBL, she on average handles 9-10 orders at a time. She plans to continue expanding her business with support from FWBL.

- December 4, 2008

- November 19, 2008

- Clinton Global Initiative 2008

- First Women Bank Ltd. and Depilex Smile again join hands

- Ms. Nilofar Bakhtiar, Advisor to the Prime Minister and Minister in-charge Ministry of Women Development

- The 16th Annual Conference of First Women Bank Ltd. was held on Monday at the Hotel Pearl Continental Karachi

- Ms. Zarine Aziz , First Women Bank Ltd. called on Dr. Salman Shah, Adviser to the Prime Minister on Finance

-

First Women Bank Ltd. net profit has crossed to Rs. 1.8 billion in

the last five and half years as compared to the profits of Rs. 20 million

for the last 11 years - Ms. Aziz addressed the conference ‘Women in Power’ titled “Blazing New Trails” held in Kuala Lumpur, Malaysia. The conference was organized by Intelligence Business Networks (IBN) in commemoration with International Women’s Day.

- December 2, 2008

- July 23, 2008

- PACRA upgrades the ratings of First Women Bank Ltd. (FWBL)

- Ms. Zarine Aziz president FWBL address at international conference at Dhaka

- Ms. Zarine Aziz, President. performed the computerised Hajj balloting at the Head Office

- Ms. Zarine Aziz President First Women Bank Ltd., keynote speaker of the Business Breakfast at the Institute of Bankers

- Ms. Aziz, during her visit to Grameen Bank, Dhaka met Prof Dr. Muhammad Younus.

- Ms. Fatima Rafsanjani visited FWBL Head Office and met the President of the Bank. Iranian delegation has shown keen interest in replicating FWBL’s model in Iran.

- Ms. Zarine Aziz President First Women Bank Ltd. represented Pakistan as speaker at a two-day conference Women in Power 2006 titled 'Blazing New Trails' held in Kuala Lumpur, Malaysia

Rehabilitation of FWBL by the Government of Pakistan